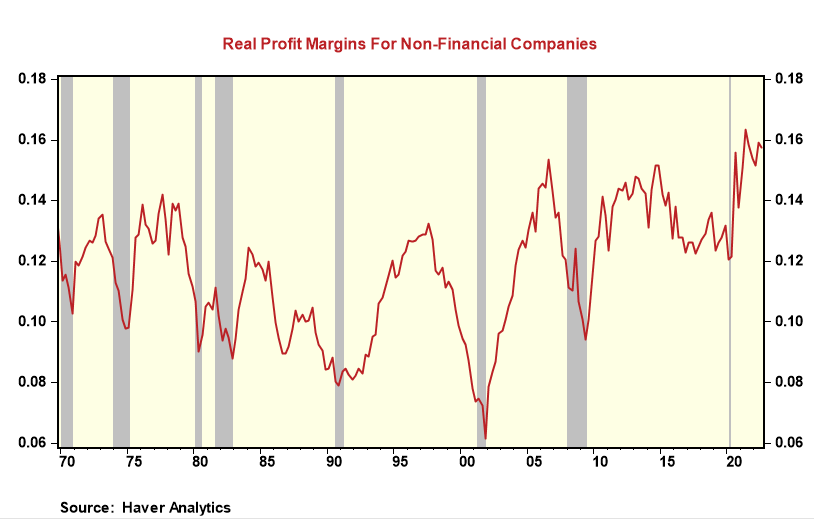

"It ain't over until it's over," quoting Yogi Berra, but this has been a "painless" tightening cycle for companies. According to the profit data for nonfinancial companies, profit margins (adjusted for inflation) for the first three quarters of 2022 have averaged 15.6%, essentially matching last year's figure, which was the highest in 60 years.

In previous Fed tightening cycles aimed at slowing and reversing cyclical inflation forces, real profit margins declined, and by a lot. Declines of 200 to 500 basis points in real profit margins occurred during the tightening cycles of 1980, the 1990s, and the 2000s.

What makes this period different? For one, the rise in official rates, while significant in scale, up 400 basis points from the start of the year, is still far below the 6.3% rate of core inflation for the twelve months ending in October. And the nominal level of federal funds at 4% is still 500 basis points below the 9.2% growth in nominal GDP for the year ending in Q3 2022.

In short, the price increases have exceeded total unit costs for nonfinancial companies (including labor, materials, and credit borrowing). A 'pain-free" tightening cycle is not how inflation cycles end. In previous tightening cycles, companies felt the "pain" of higher interest rates, resulting in layoffs and cutbacks in spending.

In comments at the Brookings Institution, Fed Powell said, "my colleagues and I do not want to over-tighten... that's why we're slowing down and going to try to find our way to what is the right level is". As Yogi Berra said, "You've got to be very careful if you don't know where you are going because you might not get there." Since the Fed does not know where they are going, how should investors know? Investors should expect a volatile 2023.

Comments