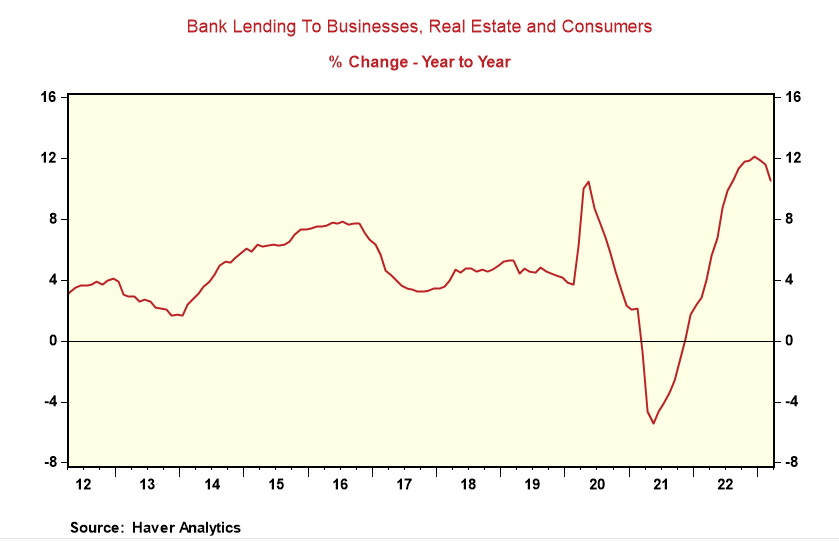

Ain't no credit crunch as banks are lending again! During the first two weeks of April, bank lending jumped $25 billion. The biggest gain of $15 billion was for commercial and industrial loans, with real estate growing by nearly $6 billion.

The gains in early April follow a contraction in bank credit in March. Bank lending to businesses, real estate, and consumers declined month-over-month in March, reflecting the bank system's stress following government regulators' closures of Silicon Valley Bank and Signature Bank.

Yet, if the US economy were facing a "real" bank credit crunch, it would decline month after month. The Fed's efforts to ease credit/financial stress are working, giving policymakers the "green light" to continue to lift official rates to fight inflation.

Comments