Bond vs. Stock Market Debate: Which Market View Is Correct & Which One Is Wrong?

- Joe Carson

- Nov 6, 2023

- 2 min read

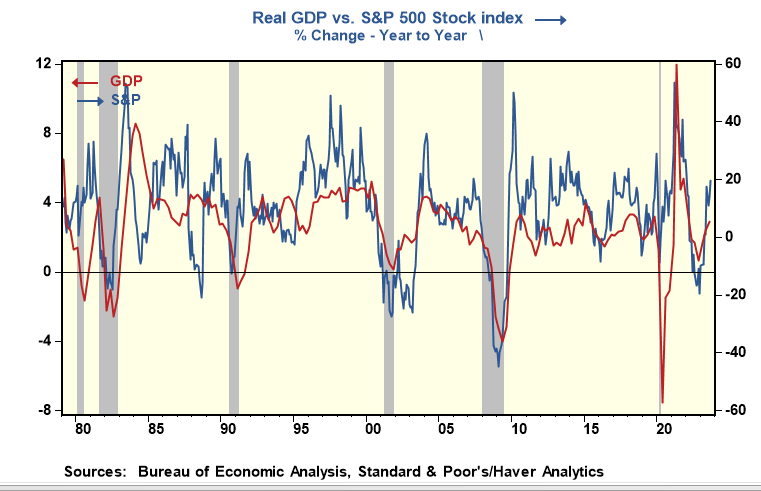

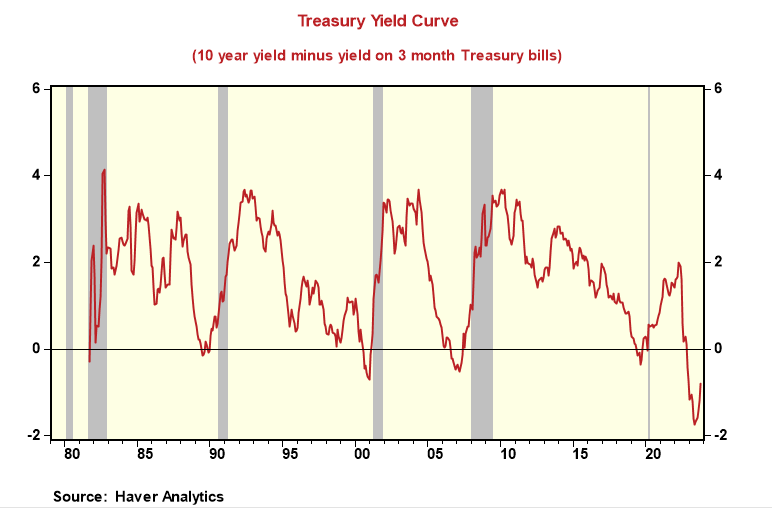

Yield curve inversion has preceded every recession since the 1980s, and while the equity market of predicting recessions is not flawless, its record of predicting faster or sustained growth is. Yield curve inversion has been in place for the past year, while the broad equity market (S&P 500) bottomed in September 2022. High double-digit percent gains in the broad equity market have consistently pointed to a rebound or sustained economic growth. Which market is right, and which market is wrong? Could there be a possible link between the two diametrically opposite outlooks?

Here's a short list of factors that favor the equity market outlook.

Operating profits are near record levels, and there has never been a recession not preceded by a sharp fall in profits.

Labor markets remain solid, and there are 1.5 jobs for every unemployed worker.

Recent wage settlements (UPS and UAW) are forward-looking and indicate sustained fast wage growth.

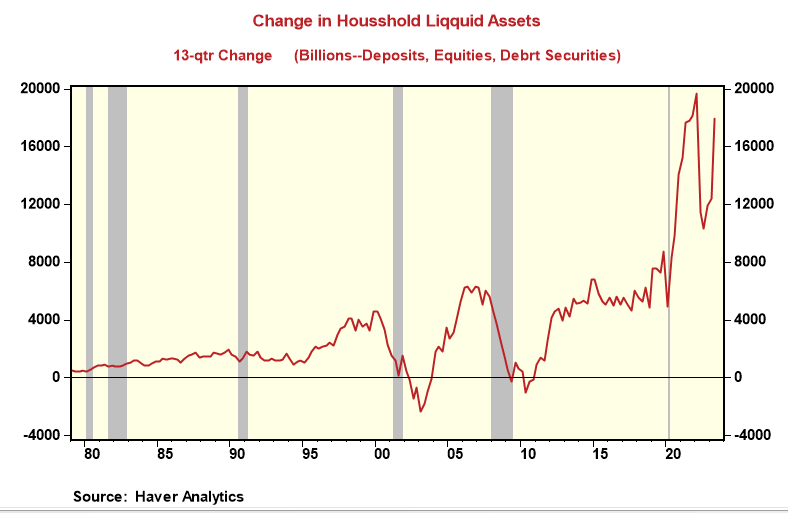

Household liquidity is near record levels, and its coverage, 2.6X times of liabilities, is far above the historical average.

Household financial and debt obligation ratios are roughly 300 basis points below the levels that preceded past recessions.

Housing is a crucial sector, and a thin supply of homes for sale provides a positive footing for growth.

Here's a short list of factors that favor the bond market outlook.

The Fed's Senior Loan Office Survey shows that a rising number of large and small banks have tightened credit standards "somewhat" in 2023. The most significant change has been tightening standards for C&I loans.

Many banks are operating with reported unrealized losses of over $650 billion. That could limit their ability to extend credit, a key factor for future growth.

Corporations have a mountain of bonds coming due in 2024 and face considerably higher interest expenses, which could result in less investment and hiring.

Delinquency rates for consumer loans are rising but still at relatively low levels.

Geopolitical risks are rising, with unknown consequences. That could quickly trigger an abrupt and sharp risk-off event, favoring bonds.

Inflation divides the two outlooks but doesn't conclusively say which view is correct. Core inflation over 4% provides some cushion for firms trying to cover the rise in unit costs and maintain operating margins. In contrast, the slowing trend in inflation keeps alive the view of future rate cuts by the Fed.

Could there be a possible link between the two outlooks? Yes. The massive quantitative purchases (QE) by the Federal Reserve, estimated to be almost $5 trillion at one point, could be behind the Treasury curve inversion and the record jump in the liquidity position of households since QE boosted financial asset prices. To be sure, the increase in household liquid assets directly held since Q1 2020 (+18 trillion to $53 trillion) is too significant, too fast, to conclude other than something unusual had to happen to cause this scale of an increase. What happened?---An unprecedented purchase of debt securities by the Fed, roughly $5 trillion in 26 months.

If QE is the link, then the equity market outlook (barring any adverse geopolitical shock) has higher odds of painting the correct future path of the economy. Also, as the Fed reverses QE over time, it would not be surprising if a positive slopeing Treasury yield curve unfolds naturally.

Comments