Fact vs. Fiction: Understatement of Housing Inflation Exceeds "Bubble" Levels

- Joe Carson

- Mar 10, 2021

- 1 min read

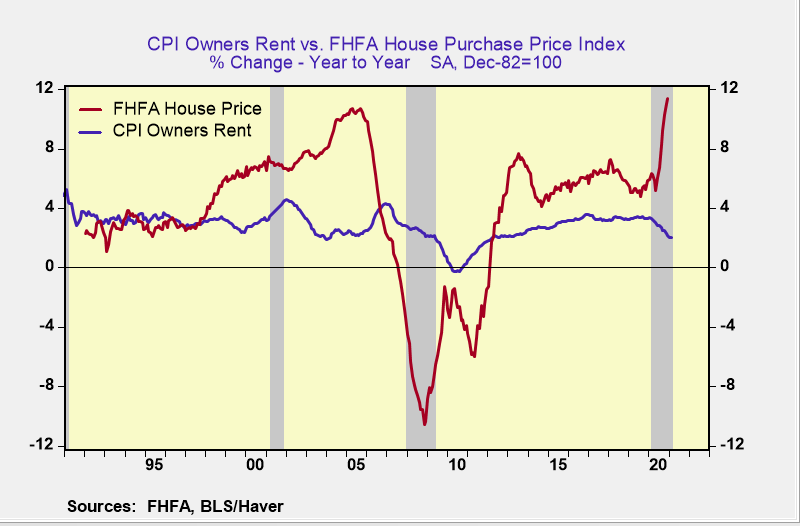

The understatement of housing inflation in the consumer price index has reached a new milestone. As reported, the gap between the actual change in house prices and owners' rent, published by the Bureau of Labor Statistics (BLS), exceeds the "bubble" levels.

In February, BLS reported owner's rent increased 2% over the last 12 months. House price inflation, as reported by the Federal Housing Finance Agency (FHFA), increased 11.4%. That gap over 900 basis points exceeds the 800 basis point gap recorded during the housing bubble peak.

The consumer price index was created and designed to measure prices paid for purchases of specific goods and services by consumers. The CPI was often referred to as a buyers' index since it only measured prices "paid" by consumers.

The CPI has lost that designation. It is no longer measures actual prices. For the past two decades, BLS imputes the owners' rent series, using data from the rental market, no longer using price data from the larger single-family market.

Imputing prices for the cost of housing services make the CPI a hybrid index or a cross between a price index and a cost of living index. A hybrid index is not appropriate as a gauge to ascertain price stability, especially when the hypothetical measure of owner's rent accounts for 30% of the core CPI.

The CPI missed the price "bubble" of the mid-2000s, and the economic and financial fallout was historic. History sometimes repeats itself in economics and finance. Policymakers forewarned.

Comments