The Federal Reserve has three mandates, maximum employment, price stability and financial stability. Financial stability has never been given the status of the other two, but it’s impossible to sustain the first two without it. Moreover, financial stability nowadays has become more than an equal along side full employment and stable prices since each of the past two recessions were triggered by financial instability, and odds are high that the cause of next recession would come from the same channel.

Financial stability creates new challenges for policymaker’s as there is some agreement on what it is, less agreement on what its not and almost no agreement on how to promote it. In a way, it has become the “forgotten” anchor of monetary policy.

The Federal Reserve Financial Stability Report offers a “bureaucratic” definition of what policymakers believe it to be. According to the report, “Financial stability is about building a financial system that can function in good times and bad, and can absorb all the good and bad things that happen in the U.S. economy at any moment; it isn't about preventing failure or stopping people or businesses from making or losing money. It is just helping to create conditions where the system keeps working effectively even with such events.”

Yet, in practice what is even more important than a definition is for policymakers to have a set of parameters or indicators to help identify when in the past a line was crossed that led to financial “instability”. That’s not to say all cycles are the same; they are not. But just as there are levels that are used to determine when price cycles get too hot or too cold there must be some thresholds for financial stability cycles.

For example, corporate debt levels relative to cash flow and nominal GDP are currently above the levels that existed before the tech bubble ---should that be an early warning sign that the financial system has entered a danger zone?

Also, the market value of domestic companies to nominal GDP at the end of 2019 equaled the record high of the tech bubble---is that a signal that the policy of low rates has elevated asset values to unsustainable levels and if reversed in a quick and disorderly way could destabilize the economy?

The problem for policymakers is that even if there was an agreement on how to identify risks of financial instability, which there isn’t, policymakers remain far part on how to promote or sustain it. Some argue that policy rates should be used, while others think the best approach is regulation. Its difficult to see how financial stability can be maintained without the use of official interest rates since financial "instability" or excessive risks can result from the current or promised setting on official rates.

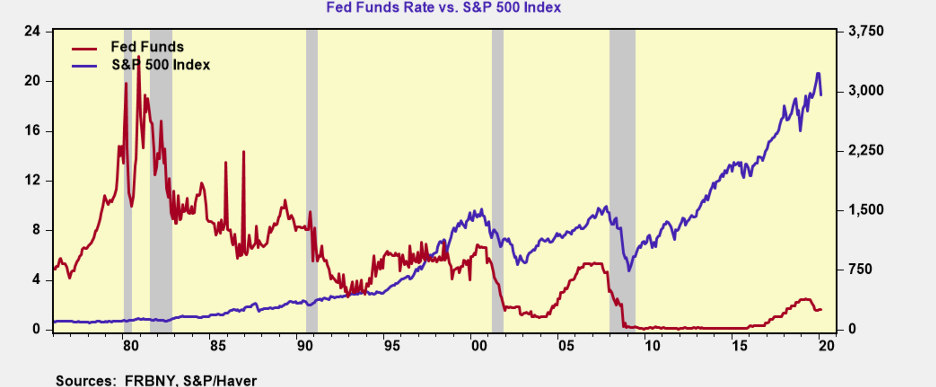

In the meantime, the policymaker’s framework of choice today remains a price-targeting regime. This policy framework is clearly outdated as the US has not experienced an inflation driven business cycle since the late 1980s, and has not recorded a core inflation rate of 3% or more in 25 years. Yet in that 30 year gap, the US has experienced two different types of recessions, driven by debt-fueled financial and real asset price cycles that proved to be as destabilizing, if not more so, than the inflation cycles of the 1970s.

Forty years ago policymakers hiked official rates to over 20% to break the back of destabilizing and repeating inflation cycles. Forty years later could it be the lowering of official rates to 1% (or less) ushers in a new phase of financial instability and the end to potentially destabilizing and repeating asset price cycles? That's because, at some point, very low bond yields would equate to lower P/E multiples as they reflect lower earnings growth and very low nominal economic growth.

Commentaires