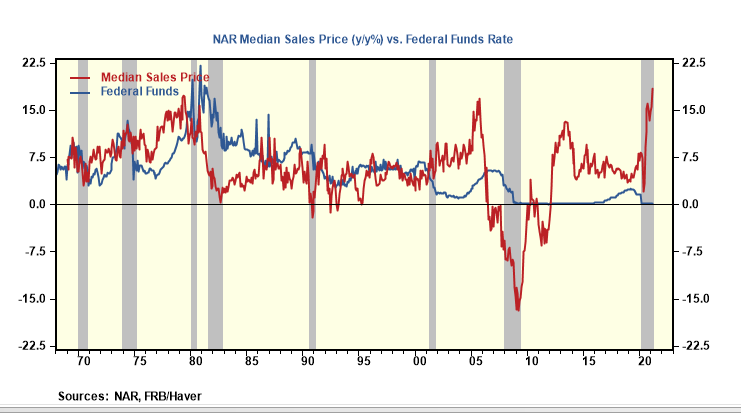

The National Association of Realtors reported that existing house prices in March were up 18.4% over the same period one year ago. That increase eclipses the prior record increase of 17.4% recorded in June 1979.

In 1979, Mr. Paul Volcker was the Chairman of the Federal Reserve. Volcker came into office with the primary goal to restore price stability. House prices were part of the consumer price index in 1979, and it, along with other price increases, was seen as creating unstable economic and financial conditions. Volcker lifted official rates to near 20% to break the back of inflation. The outcome was nearly three years of economic recession from 1980 to 1982.

In 2021, Mr. Jerome Powell is the Chairman of the Federal Reserve. Mr. Powell does not view house price increases the same way as Mr. Volcker. Perhaps its because house price is not part of the consumer price index, so it does not create the same systemic fears of 1979. Also, policymakers nowadays believe that "macroprudential" tools (i.e., limits of loan-to-value ratio and caps on debt-service to income) are a better way to limit potential asset bubbles and promote financial stability. The economic and financial outcome is unknown at this time, but history does not paint a bright picture.

Lessons from broad (1979) or narrow (2000s-housing) inflation cycles show the longer it takes to break the spiral, the greater the adverse economic and financial outcomes. That's because inflation cycles create income and paper wealth, while the reversal triggers widespread income and financial losses, sometimes bigger than the initial gains.

Monetary policy that supports the extension of easy money when house prices are rising at record rates makes no sense. It's one thing to misread the tea leaves of an asset bubble, but it's another thing to be the enabler.

Comments