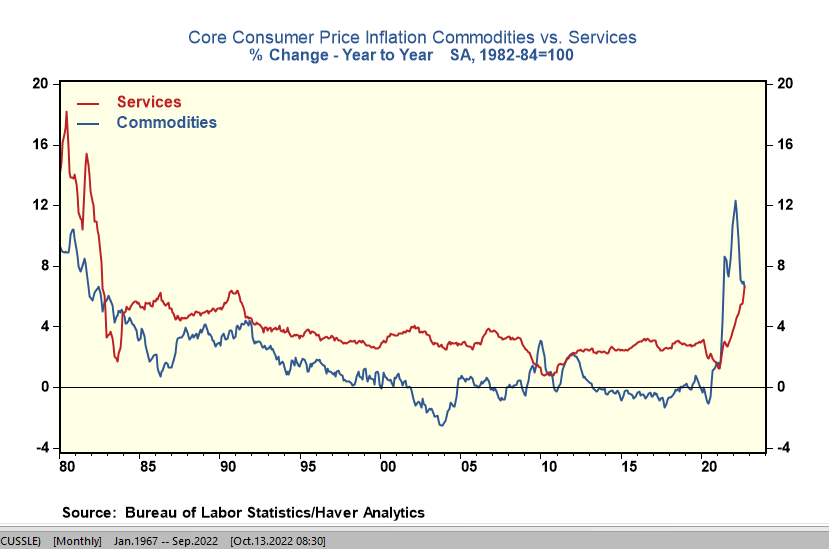

September's report on consumer prices is another painful reminder that inflation cycles rotate and broaden over time. Last month, prices for core consumer services rose 0.8%, while prices for core commodities were unchanged. That's the reverse of what happened early in 2022 when consumer price inflation was driven by significant increases for goods, with service prices running half as fast.

Through September, core inflation for goods and services match, advancing by 6.7%. The last time both core measures were this high occurred in 1982.

Still, some suggest that the inflation cycle is not as bad as it appears. According to analysts, the current report overstates inflation since it is driven primarily by the owner's rent, which lags the actual rent changes by several months.

First, the Bureau of Labor Statistics (BLS) publishes a particular price index, total CPI less food, energy, shelter, and used vehicles. This price index rose 0.6% in September over the prior month and now stands at a new cyclical high of 6.7%, the most significant annual increase since 1982. So to say increases in owners' rent overstate inflation is false. Inflation is everywhere, not just in the owner's rent series.

Second, the owner's rent series is an odd duck, which is hard to defend. BLS stopped tracking owners' rents, citing a lack of good data. So BLS uses rent data from the non-owner market to estimate rents for the owners market even though the two markets are separate. BLS measures rents on a six-month basis, so there is a slight lag in the published rent data relative to market rents. But those that argue current readings of inflation overstate actual inflation due to the lag in rents never said that reported inflation in late 2021 and early 2022 was understated.

Moreover, the Fed staff is well aware of the lags in the CPI rent data, has published reports on this subject, and has warned about the potential lift to reported inflation. In August 2021, researchers at the Federal Reserve Bank of Dallas issued a report that argued CPI rents could potentially rise at their fastest rate in 30 years over the next few years. Those researchers predicted CPI rents would increase by 6.9% in 2023. In September, CPI rents were up 6.7, so the research staff call was early but accurate.

So policymakers knew that rising rents, with their considerable weight in the CPI, would drive core inflation higher in 2022 and beyond. That made the delay in hiking official rates even more indefensible, with painful consequences for the economy and the financial markets.

Comentários