Inverted Yield Curve Not A Sufficient Condition For Recession-Credit Growth & Rate Levels Matter To

- Joe Carson

- Dec 30, 2022

- 2 min read

The inverted Treasury yield curve has raised concern over the risk of recession in 2023, and for a good reason. An inverted yield curve has occurred before the past eight recessions. Yet, something is awry. Banks are not restricting credit as they typically would with an inverted yield curve, and businesses and consumers are borrowing at banks at the fastest rate in fifteen years. What's up?

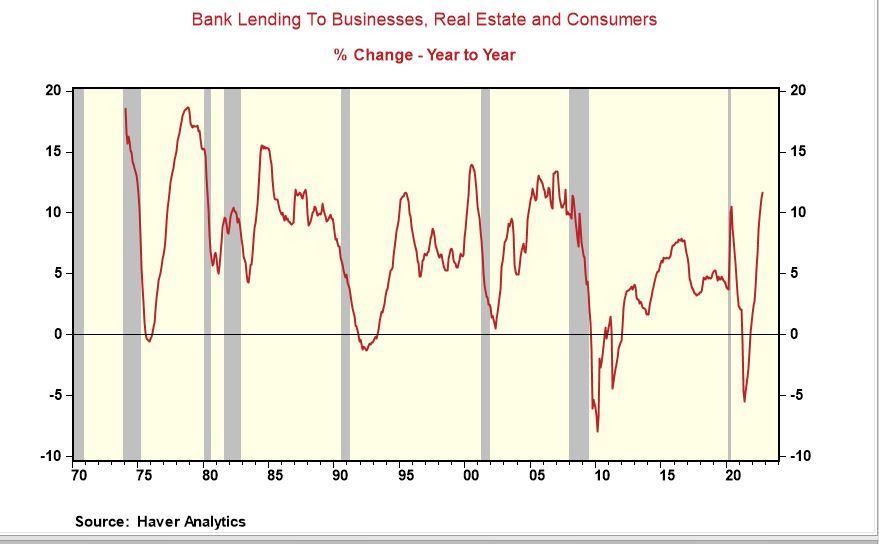

The thinking behind the inverted yield curve is that banks slow and eventually stop lending when bank funding costs exceed what banks can earn by lending. Yet, bank credit has been accelerating throughout 2022. The latest data for November shows bank lending to businesses, real estate, and consumers rising 11.8% over the comparable period one year earlier. That's the fastest annual growth since 2007.

Why are banks lending so much with an inverted yield curve? Banks' total costs of funds are not determined solely by the rate of federal funds. Customer deposits account for half of the funding costs for many big banks. And with customer deposit earning (or costing) less than 70 basis points, the bank's all-in funding costs remain relatively low. So it's still profitable to lend nowadays.

That raises questions about the recessionary signal from an inverted yield curve because, in previous periods of inverted yield curves, bank lending slowed sharply, often contracting (see chart). Can the inverted yield curve signal be trusted if bank credit is accelerating, not slowing, or contracting as in previous periods? I would think not.

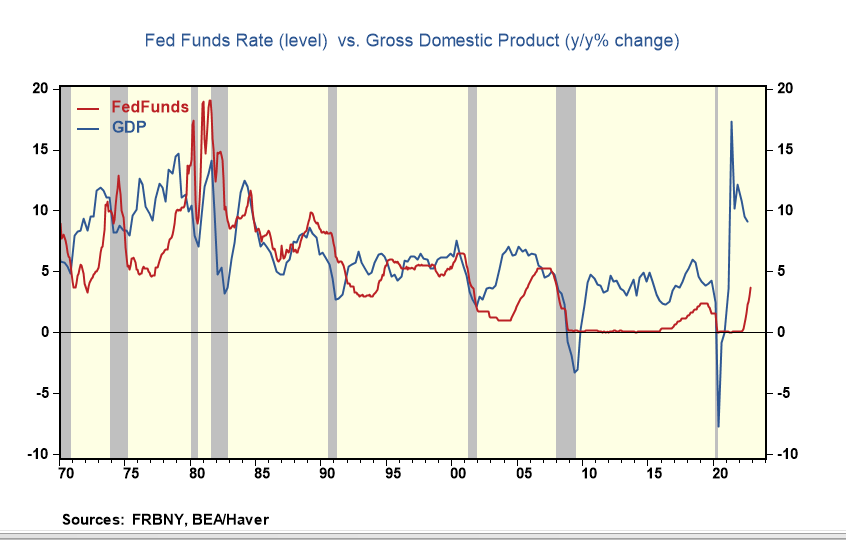

Also, why are businesses and consumers still borrowing briskly after the Fed substantially raised official rates? Because the federal funds rate is not crushingly high, at least not yet. In the past, the federal funds rate proved restrictive when its level equaled or exceeded the growth in gross income and output (see chart). In other words, to slow domestic demand, the Fed had to raise rates equal to or above the increase in gross income and output.

At the end of the third quarter of 2022, the growth in GDP exceeded the Fed funds rate by almost 600 basis points. That's huge, indicating the economy is far from one of the conditions in place before prior recessions. Even if the Fed median forecasts of higher official rates and markedly slower nominal growth are on the mark, the GDP-Fed funds' gap will not be closed before mid-year 2023. A recession beginning around mid-year runs counter to the bullish forecasts of a strong half for 2023.

Many believe an inversion in the market yield curve, or the spread between the yield on three-month Treasury bills and the 10-year treasury, is a robust forecasting tool due to its consistent and reliable track record. Yet, yield curve inversion, by itself, is not a sufficient condition for an economic recession. Slowing or contracting credit growth and official rate levels equal to or exceeding income growth are also necessary conditions. Those conditions are not present, so until they are, the yield-curve recession signal will remain a forecast, not a reality.

コメント