The recent rally in equities, bonds, and the narrowing credit spreads has been impressive. It hinges on the view that the Fed's war against inflation is over, or almost so, and a new economic and profit cycle will begin soon. Yet, the downcycle in prices and the fallout in the economy and company profits has not started yet.

For investors looking beyond the economic slowdown, it is mathematically impossible for the Fed to lower inflation to 2%, from the current 8% to 9% range, without triggering a sharp decline in operating profits.

In the last twelve months, nominal GDP has increased by 9.3%, with the price component rising 7.5% and the output component rising 1.6%. And what happens on the output side also occurs on the income side since nominal GDP and Income are mirror images.

In the past year, nominal income has been up an estimated 10%, a bit more than the reported 9.3% gain in GDP, with employee compensation rising 10% and operating profits less than 3%.

The Fed does not directly target GDP prices. Still, consumer prices make up the lion's share of GDP prices, so lowering consumer price inflation to 2%, down from 8% to 9%, would result in a dramatic drop of about 500 to 600 basis points in Nominal GDP growth, with a parallel downward move in nominal income.

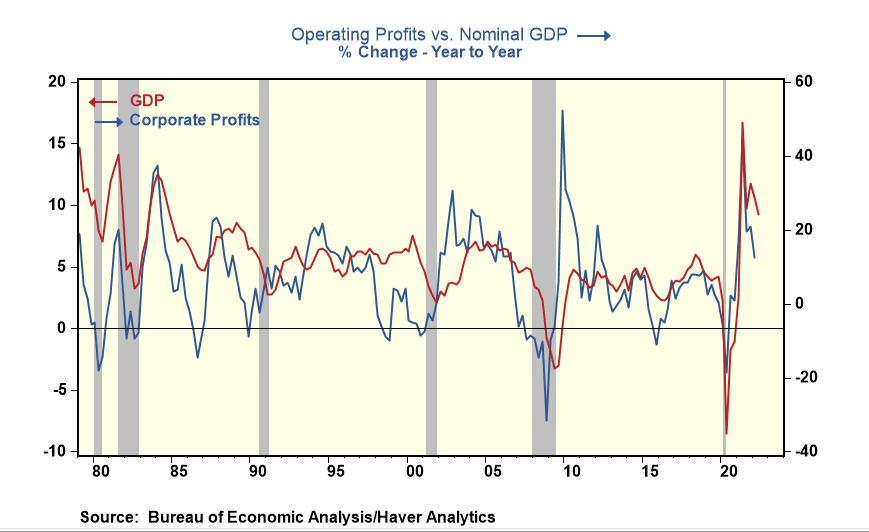

In the last 30 years, nominal GDP growth has dropped that much three times (1989-90. 2000-01, and 2007-09), excluding the pandemic non-economic recession. Each of the three sharp declines in nominal GDP resulted in an official economic recession, with 2007-09 being the worst one of the post-war period at that time. Aggregate operating profits posted negative numbers before and sometimes during the recessions.

What makes the current situation unique is that the Fed is fighting inflation against a backdrop of a labor shortage. How does the Fed squash inflation when labor costs are rising? And for investors, the more significant issue is what happens to companies operating profits if Fed lowers inflation and nominal output and income growth slow accordingly, and employee compensation slows only half as much. That points to a sharper decline in operating profits far more significant than analysts and strategists expect.

The scenario that could be a win-win for investors is if the Fed raises official rates, inflation slows, and real output increases. That would result in a smaller decline in operating profits. In my view, the odds of that occurring are very low as it has never happened before.

Some may disagree, citing the 1994/95 slowdown. Back then, the Fed was trying to stop inflation from accelerating. This time the Fed is trying to lower a significant and broad inflation cycle, the biggest in 40 years. The economic and financial consequences are much different when inflation has accelerated. Price increases have already inflated income and profit figures, so unwinding inflation creates more harm and dislocation than trying to stop it from occurring in the first place.

Yet, investors disagree and are betting that ending inflation cycles do not trigger the economic harm, profit, and job declines of past cycles. It is hard to fight the tape, but it's even riskier to defy economic common sense.

Comments