Investors should be cautious of a policy pause or pivot as it might bring short-term gain at the expense of long-term pain. No one is better than Mr. Volcker at knowing that quick pivots or reversals in the fight against inflation don't end well. Mr. Volcker abandoned his inflation fight in early 1980 following the sharp plunge in the economy (at the time, it was the sharpest one-quarter drop in GDP in the post-war period) associated with the imposition of credit controls.

After lifting official rates by more than 1000 basis points over several months, Volcker dropped them equally fast, only to resume his inflation fight later in the year. Volcker eventually raised official rates to higher highs in the next two years, underscoring the critical point of inflation cycles; that they do not die quickly or easily.

Nowadays, there is nothing on the horizon that would trigger an economic decline equal to that of the 1980's drop. But that's not the critical point. Killing inflation cycles require a significant reset of economic and financial conditions following a fundamental tightening of monetary policy. The sharp two-day rally in equities this week based on the slightest hint of a policy pause shows investors' risk-taking appetite is alive and well. If that is still alive, so is the economy's growth and inflation appetite.

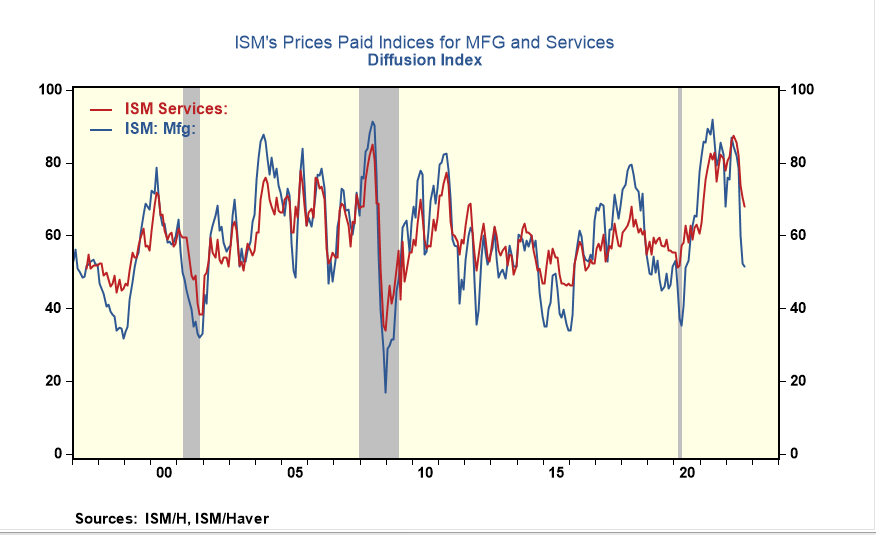

Yet, it is hard to deny that things are lining up for Fed Powell to pause at some point. For example, prices paid diffusion indices from the Institute of Supply Management for manufacturing and the service sector provides a snapshot of cost pressures. Both price measures fell to their lowest levels in roughly two years in September.

Yet, it is worth noting that diffusion indexes track the breadth of increases (or decreases) and do not distinguish the magnitude of change. So while cost pressures have subsided, they have not disappeared completely. Also, the service sector's price index at 68% remains elevated, which has to do with two things: services use fewer commodities than manufacturing, and labor is a more significant part of their cost. Since the inflation cycle is increasingly becoming a service sector phenomenon, rising labor costs remain the biggest wild card for the inflation cycle.

The number of job openings stood at 10 million in August, off 1.1 million from July, but still far above pre-pandemic levels. And, with 1.7 job openings for every unemployed worker, companies, especially in the service sector, will need to pay up to attract labor.

Tightness in the labor markets will not be an obstacle for Fed Powell to pause after the Fed follows through on hiking rates at the next two meetings, as suggested in the latest policymakers' projections. Yet, it does create the risk of a pickup of inflation and higher official rates later. That's because, without sufficient slack in the labor markets, companies would still face the same labor cost conditions as they do today, raising the prospect of an extended inflation cycle.

Inflation cycles are not linear, nor do they end in a day, week, or month. It takes time to stop and reverse. Policymakers say they must maintain restrictive policy rates for some time to kill inflation. Yet, will politics and investors let them?

Kommentare