Some have used peak inflation to create the impression that the worse of inflation news is in the rear and that the Fed has less tightening to do than what many expect. Yet, peak inflation says a lot about what the Fed has to do, which should worry the Fed and scare investors.

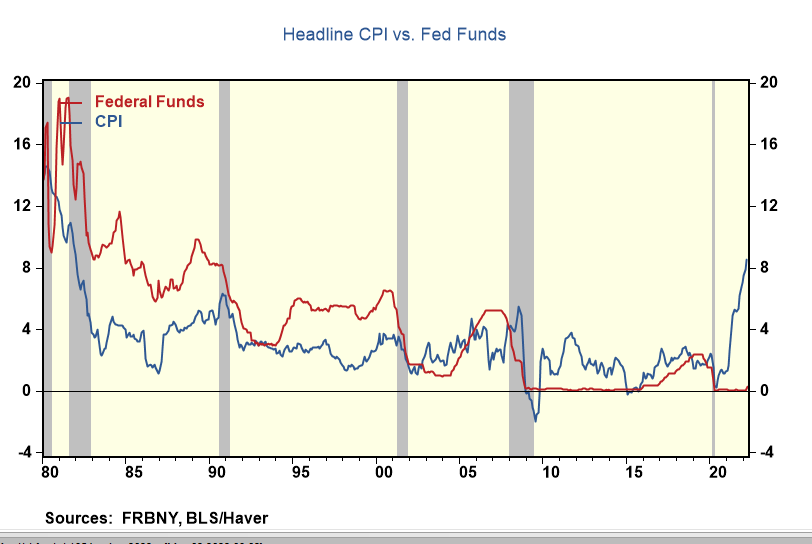

In three out of the last four decades, the US experienced a cyclical rise in inflation (4% and above) that compelled policymakers to raise official rates in response. It didn't matter if the inflation cycles were broad (the early and late 1980s) or narrow (oil spike in the mid-2000s). But policymakers had to raise official rates above peak inflation on each occasion to squash the price cycle.

No one is thinking the unthinkable that the Fed has to raise rates above the 8.5% increase in consumer prices over the past year. Yet, past experiences provide painful lessons on the level of official rates required to reverse inflation cycles.

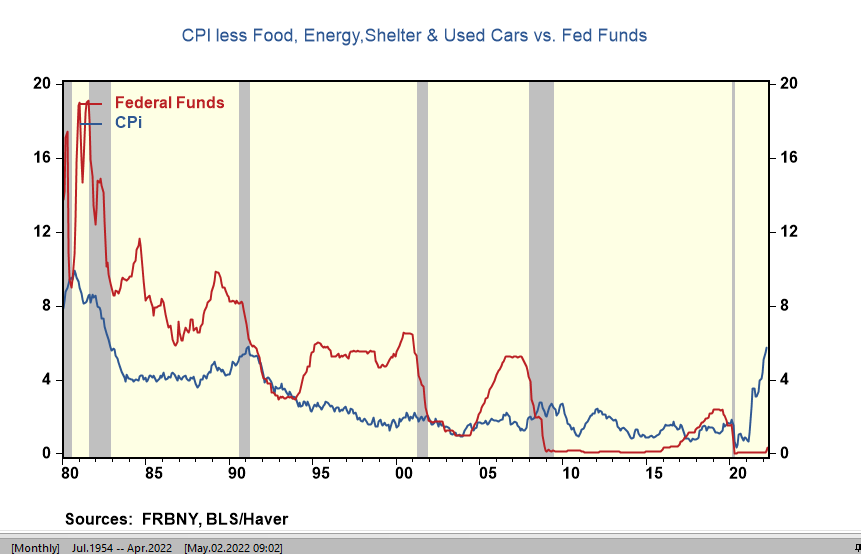

Each inflation cycle has common and unique factors. However, many, including Fed officials, have argued that the current inflation cycle has more than a few items lifting prices temporarily. The Bureau of Labor Statistics (BLS) produces a special aggregate series that removes some things people have cited, so it helps remove some of the noise.

For example, BLS published a series of CPI less food, energy, shelter, and used car and truck prices. This series removes the recent temporary spikes in food and energy prices linked to the Russian invasion of Ukraine. It also removes the massive spike in used vehicle prices associated with supply bottlenecks owing to the pandemic. Yet, this dumbed-down price series still shows a 5.8% in the past year, matching the highest rate recorded in 40 years.

So even if this is the inflation rate the Fed needs to target to reverse the inflation cycle, it still calls for a fed funds rate of 6% or more than twice the peak rate shown in policymakers' official rate projections made in March.

Given how tight the labor markets are nowadays and everything else being equal, it would probably take a 6% fed funds rate to impact consumer demand and dampen inflation by creating more unemployment. At the end of March, there were a record 11.5 million job openings against a backdrop of 6 million unemployed. Never before has the Fed faced a significant inflation cycle with labor markets this tight.

Yet, I would bet that long before the fed funds rate gets close to 6%, something else would break to stop the Fed. Things that stopped the Fed in the past were an abrupt and sharp drop in the financial markets or a cessation in the flow of credit that could lead to economic and financial instability.

Given the current market environment, none of those conditions are present, so the risk, for now, is that Fed tightening course could look a lot like those of the past until something else breaks. Investors forewarned.

Comentários