Something's Wrong: A Debt-Financed Recession

- Joe Carson

- May 22, 2020

- 2 min read

The Fed’s debt-bridge policy is designed to improve the flow of credit to businesses to avoid a devastating credit crunch. Never before has one of the monetary policy solutions to combat recession been to extend credit to struggling, profit losing businesses.

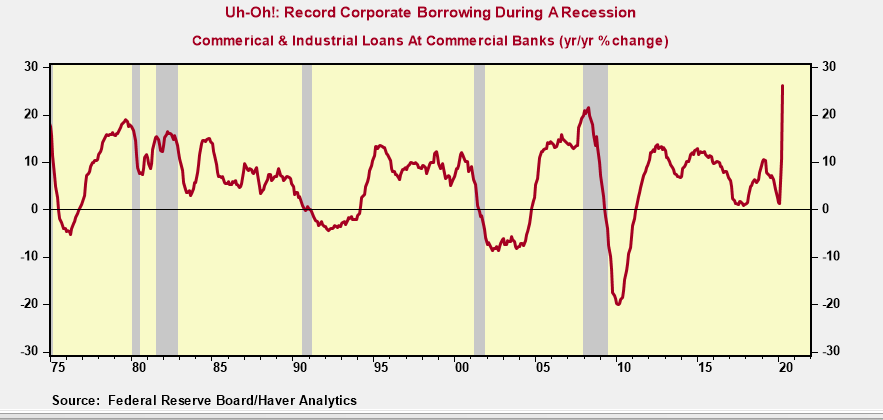

There is no precedent for record business borrowing during a recession. The scale of business failures during and after the economy exits recession will far exceed that of the Great Financial Recession.

The Fed’s Debt-Bridge Policy

The traditional way for monetary policy to build a bridge from recession to recovery is through the lowering of official interest rates. In time, the reduction of interest rates triggers a refinancing cycle, lowering interest costs, and improving liquidity positions. The “reliquification” process enables firms (and individuals) to exit recession with stronger liquidity and lower debt burdens.

With official interest rates relatively low the “reliquification” process was not a viable policy option to combat the abrupt contraction in the economy. So policymakers were forced to support the flow of credit to the economy by purchasing securities and provide direct financing to sectors where it is not otherwise available or too costly.

So instead of contracting, which is the typical pattern during the recession, the flow of private credit has exploded to the upside.

Since the start of 2020, commercial and industrial loans have increased over $750 billion to a record $3.1 trillion. That increase nearly matches the cumulative increase in corporate bank borrowing of the past 6 years.

At the same time, US corporations have tapped the capital markets for hundreds of billions of new debt. Through early May corporations have issued nearly $300 billion in new debt, twice as much as the comparable period one year ago.

An addition of $1 trillion of new liabilities over a few months is a big number in the best of times. Yet, record corporate borrowing during bad times increases the risk of business failures and defaults. Here’s why.

A Harvard Business study released in 2010 analyzed corporate performance during three global recessions from 1980 to 2000. Sales and profit performance of 4700 public companies were analyzed three years before and three years after the recession.

The findings paint a grim picture of the devastating and lasting impact recession has on corporate performance. To be sure, a shocking seventeen percent of the companies failed were acquired or decided to go private.

Meanwhile, three years after the recession forty percent of the companies hadn’t recovered to precession sales and profit levels. And, approximately 80% of public companies had not rebounded to their pre-recession growth rates in sales and profits a full three years after the recession.

Almost all business people agree that the current crisis marks an inflection point. The business world has changed and firms need to remake (i.e., downsize) their organizations to fit in the new normal. Companies will operate with a smaller footprint, but more debt.

There is no precedent for record corporate borrowing during a recession. As a result, investors need to brace for an economy unlikely to resemble the one before, with an uneven and slow growth, and record corporate failures.

Comments