The Federal Reserve’s new policy of inflation “averaging “ is a mistake. The trade-off nowadays is between inflation and financial stability. Buying more inflation will eventually create, if it has not already, financial imbalances that will trigger an economic crash.

The parallel to this is the misguided policies of the 1970s. Back then policymakers found buying more employment with a little more inflation did not work.

Facts Don’t Support Policy Change

Federal Reserve policymaker’s argument for the policy change is that consumer inflation has been consistently running below its 2% target. Also, sustained low inflation readings can over time depress inflation expectations, which can create “ever lower inflation and inflation expectations”. The evidence does not support these arguments.

The Federal Government statistical branches publish two measures of consumer price inflation. The Bureau of Labor Statistics publishes the consumer price index (CPI) and the Bureau of Economic Analysis (BEA) publishes the personal consumption deflator (PCE).

CPI is the basic measure of consumer price inflation. The PCE measure gets 70% of its price data from the CPI. But the PCE also includes items or services provided to consumers by businesses and government. BEA uses a lot of imputations (non-market prices) to value these items and services since these items are not “sold” to the consumer.

In the 4 of the past 5 years, core CPI has been running above the Fed’s 2% target. The only year of the past 5 when core CPI ran below 2% was 2017 when it ran 1.8%. That small shortfall is not statistically significant and surely does not warrant a fundamental change in policy.

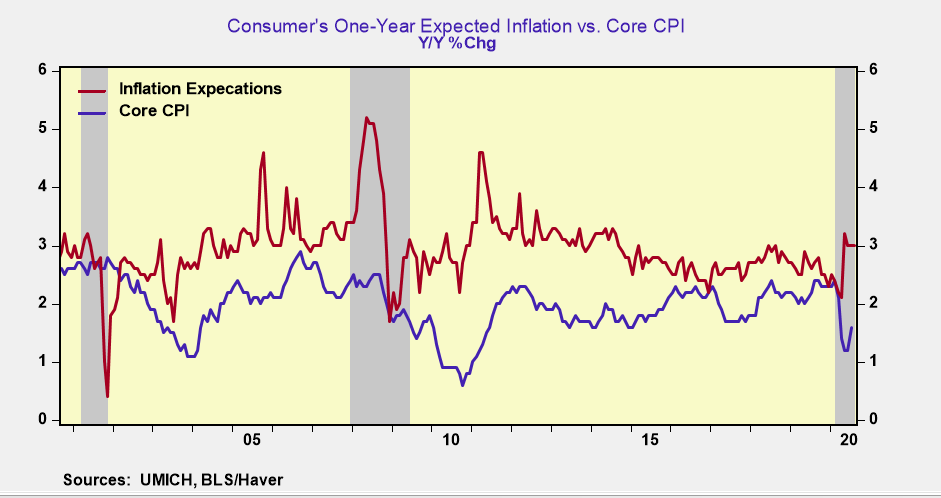

Also, the argument the low reported inflation is undermining consumer inflation expectations are not supported by the facts. Consumer’s one-year inflation expectations from the University of Michigan consumer sentiment survey shows that people’s inflation expectations have consistently run above-reported inflation and the 2% target.

In the past two decades, the only times consumer inflation expectations dropped below 2% was during 9/11 and the Great Financial Crisis. And each drop in expectations was short-lived. Consumer inflation expectations currently stand at 3%.

The Federal Reserve has three mandates, maximum employment, price stability, and financial stability. Financial stability is often overlooked or ignored. The last two recessions were triggered not by inflation running too high or too low, but by real and financial asset prices running too hot. Current macro valuations asset valuations now exceed the high thresholds of the last two asset bubbles.

Changes in monetary policy often have unintended consequences. Trying to buy more inflation is a mistake. It’s a policy mistake because actual inflation has been running above target. But the bigger problem is that the new policy will trigger more speculation and risks in finance at a time when asset values are already at nosebleed levels.

The misguided policies of the 1970s eventually ended with an economic crash. Will this time play out differently? I have my doubts. That's because over exuberance in finance or in the economy creates imbalances that naturally correct. The big difference today versus the 1970s is that the US does not have the policy defenses ---with official rates at zero and budget deficits in the trillions--- to cushion the fall.

تعليقات