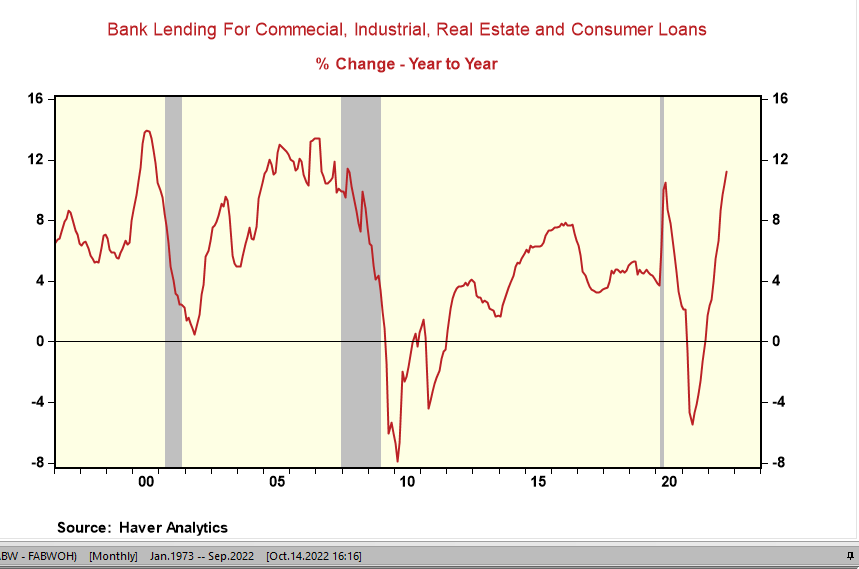

Uh-Oh!. The credit boom gets stronger; bank lending for commercial, industrial, real estate, and consumer loans increased by 11.7% in the last twelve months ending in October. That's 50 basis points faster than the previous reading. C&I and real estate lending accounted for the acceleration. In the past year, C&L loans are running at +15.2%, consumer loans (including credit cards) at +12.6%, and real estate at 9.6%. How does the Fed stop an inflation cycle with easy credit? It doesn't.

top of page

Search

Recent Posts

See AllThe DOGE team turned down the budget proposal, heightening the chances of a government shutdown. Budget reconciliation is crucial because...

131

Over the past several decades, the methods of measuring inflation has changed significantly, frequently shaped by political influences...

551

At the beginning of every FOMC meeting, the Federal Reserve's research team provides an analysis of economic growth, inflation trends,...

1200

bottom of page

Comments