The Wall Street Journal article "Jobs Data Mudlle Labor Market Analysis" is misleading, as it bases its conclusion on a small data set. The main point is that the labor market is not as robust as the payroll data suggests since, in the last three months, household employment fell an average of 116,000 per month, which is in sharp contrast to the 375,000 average payroll gain.

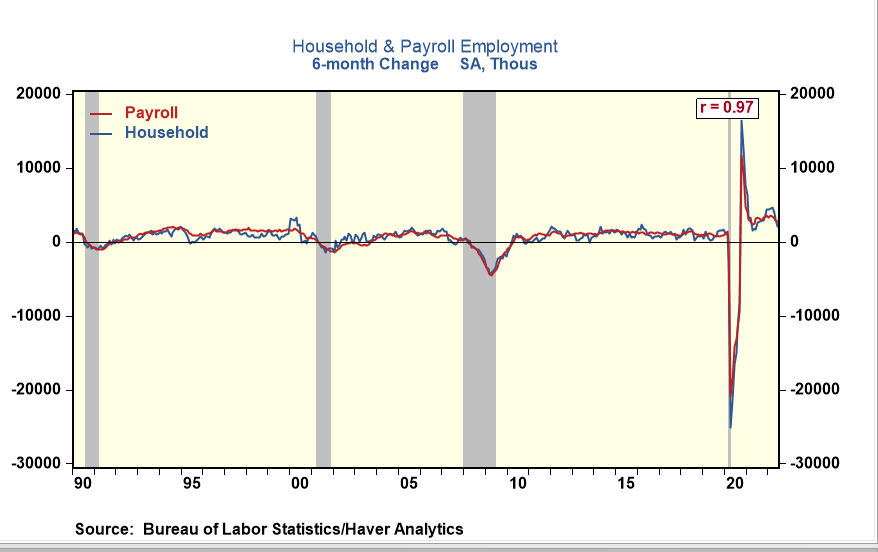

Yet, the script reverses if looking at Q1 data. In Q1, household employment posted average monthly gains of 828,000 versus 538,000 for payrolls. Household employment data are more volatile than payrolls, and when viewed over a longer span of 6 months, the two series usually run up and down equally.

The most critical indicator in the household survey is the jobless rate. The civilian unemployment rate increases or decreases with changes in the labor force and employment. Yet, history shows it is the change in the jobless rate and not the underlying factors of the number of employed and people entering or leaving the labor force that offered the most accurate assessment of the state of the labor market.

In the last three months, the jobless rate remained steady at 3.6%, near the 50-year low, and off 0.3 percentage points since the start of the year. The bottom line is that the jobless rate sends the same signal as the payroll data; the labor market remains robust.

As a result, June's household employment data is not a sign of pending weakness in the labor market. The jobless rate would need to increase at least 0.2 percentage points or more each month over two- to three months to signal a trend change.

Comments